Accurate revenue recognition has always been important. It reflects the true extent of revenue earned during a specific period. It also gives valuable insights, protects brand image, and assists potential investors in determining the value of your business.

However, since December 2019, when the new ASC 606 rules came into force, it is now mandatory for private companies to accurately report earned and deferred revenue. This is a requirement that is particularly challenging for subscription-based and SaaS businesses.

Revenue Recognition 101

Whilst your customers might pay you up front for a year's worth of usage you won't be able to categorise that entire amount of cash as revenue right away.

Revenue must be recognised at the time when goods and services are transferred to the customer, in an amount that is proportionate to what has been delivered at that point.

Set-up costs, if they are not optional, must also only be recognised over the period in which the service is delivered.

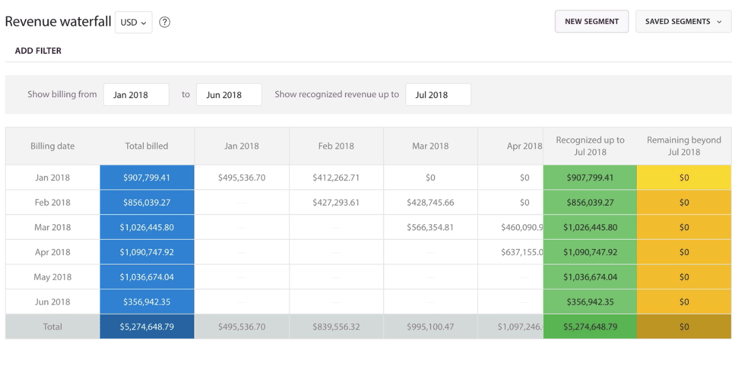

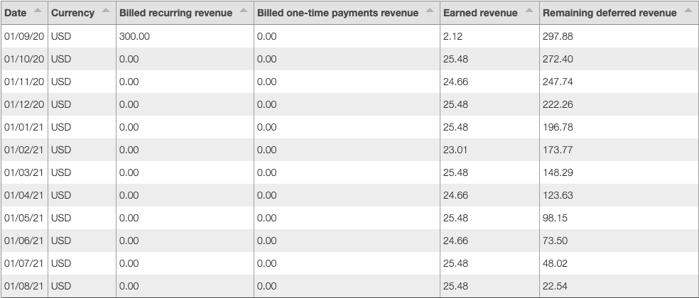

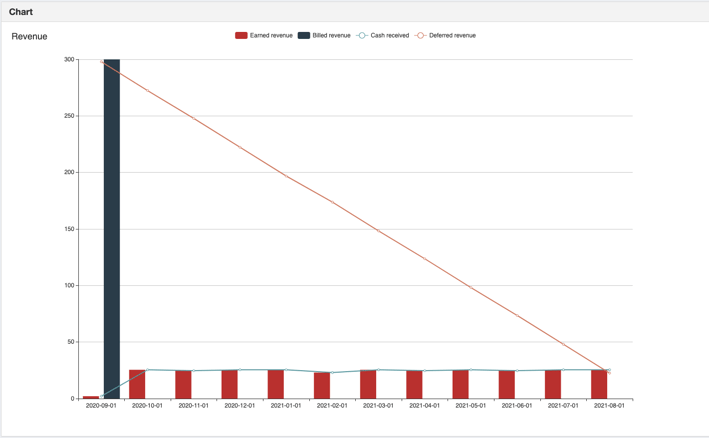

For example, during the life of an annual subscription, each month 1/12 of the value of the subscription will become “earned revenue”. The balance of what has not yet been earned is known as “deferred revenue”. The process of revenue moving from deferred to earned is know as a “revenue waterfall”.

This can be viewed at a business level or down to the individual subscription or customer – in a table or chart.

Why is revenue recognition hard to calculate?

In a subscription business, revenue often needs to be recognized daily. This is extremely hard to accomplish manually, in a timely fashion, and without error. Subscriptions are received every day, and each results in a unique revenue recognition calculation. This is a labour-intensive and expensive task.

When you factor in the varying nature of subscription-related services, with contract modifications, downgrades, upgrades, and so on, this can make revenue recognition even more challenging.

How does Billforward help you easily calculate your deferred and earned revenue?

Billforward takes the subscription data from your customers and automates all the calculations that allow you to see accurately what revenue has been earned at any time during the lifecycle of a subscription.

The revenue recognition reports are highly configurable and will allow you to:

- Bucket revenue by day or month

- Select single or multiple rate plans

- Filter by customer or subscription ID

- Group by invoice, subscription or pricing component

- Filter out set up charges or include them

The report can be seen in chart and tabular format or alternatively exported in csv.

If you group by invoice, it can also generate a pivot table to give you an instant detailed view of all activity for your financial reporting.

It’s essential that you comply with ASC 606 – along with GAAP and IFRS. Instead of having to track recognised earned and deferred revenue with manual spreadsheets, why don’t you let our software simplify the entire process.

Why not book a discovery call with one of our billing experts and see how we can help you meet your subscription goals!